28+ I have equity but bad credit

This is to protect the lender if you default on the loan. Lenders that offer home equity loans will likely require the following.

Power Players 2022 Memphis Magazine

Get The Funds You Need Quick.

. Home equity loan borrowers see an average drop of about 13 points on their credit score. Having bad credit is likely a result of a failure to make payments on an existing agreement or having made some payments late. Find The Best Home Equity Rates Right Now With Lendstart.

Ad Consolidate 20000 or more. Ad Call to find out more. See The Best Rates Online.

Home equity of at least 15 to 20. Lenders generally require a credit score of 620. Ad Use Lendstart Marketplace To Find The Best Option For You.

Ad Take Out Funds For Home Improvements Or Debt Consolidation. Ad Use Lendstart Marketplace To Find The Best Option For You. Unfortunately opening a home equity line of credit or refinance loan still depends on a lot of factors including.

Compare Save With LendingTree. Get More From Your Home Equity Line Of Credit. Get Expert Help With Your Credit Score.

Get a Quote Today. Ad The Average American Has Gained 113000 in Equity Over the Last 3 Years. Having more than 15 equity can increase your chances of approval with bad credit.

Be Debt-Free Faster Than You Think. Get Lowest Rates Save Money. Applying for any loan requires an in-depth application process.

Thats largely due to the fact that the loan adds to your overall debt burden. 1 Low Monthly Payment. 1 A score this low can make it tricky to.

Cut Debt by 50 or More. Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score. Ad Compare The Best Home Equity Lenders.

Compare The Best Home Equity Loan Rates Online Today With Forbes Advisor. Ad 2021s Best Credit Repair Companies. Easy to OwnSM programs give options for those with lower income limited credit history and low down payment needs.

Although these requirements may be different from the lender you find here are a few common examples of standard lender qualifications. Get Started in 5 Mins. Many lenders may issue a loan.

Find The Best Home Equity Rates Right Now With Lendstart. Requirements to obtain a home equity loan. If you have bad credit meaning a credit score of less than 579 you may still qualify for a home equity loan or line of credit if you can satisfy other lender requirements.

Get The Funds You Need Quick. Wells Fargo Home Mortgage. A FICO credit score below 620 is considered bad credit for a home equity loan notes Lyle Solomon a financial expert and attorney in Rocklin California.

The requirements vary by lender but a FICO credit score of 620 is typically the lowest to get approved for a traditional first mortgage. See Cards Youre Pre-Approved for With No Harm to Your Credit. Why is Equity Release ideal for people with bad credit.

Ad Apply With More Confidence.

Free 28 Financial Statement Forms In Pdf Ms Word Excel

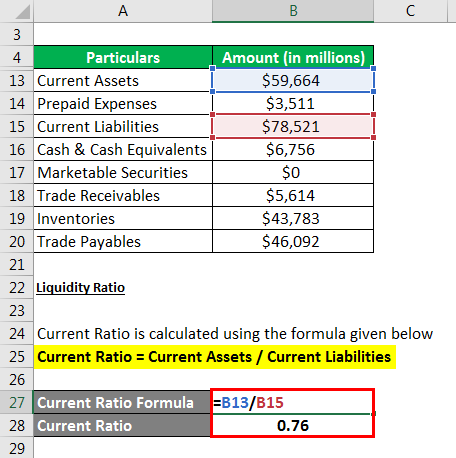

Total Debt Service Ratio Explanation And Examples With Excel Template

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

28 Dazzling Nail Polish Trends You Must Try In 2022 Unhas Unhas Decoradas Unhas Compridas

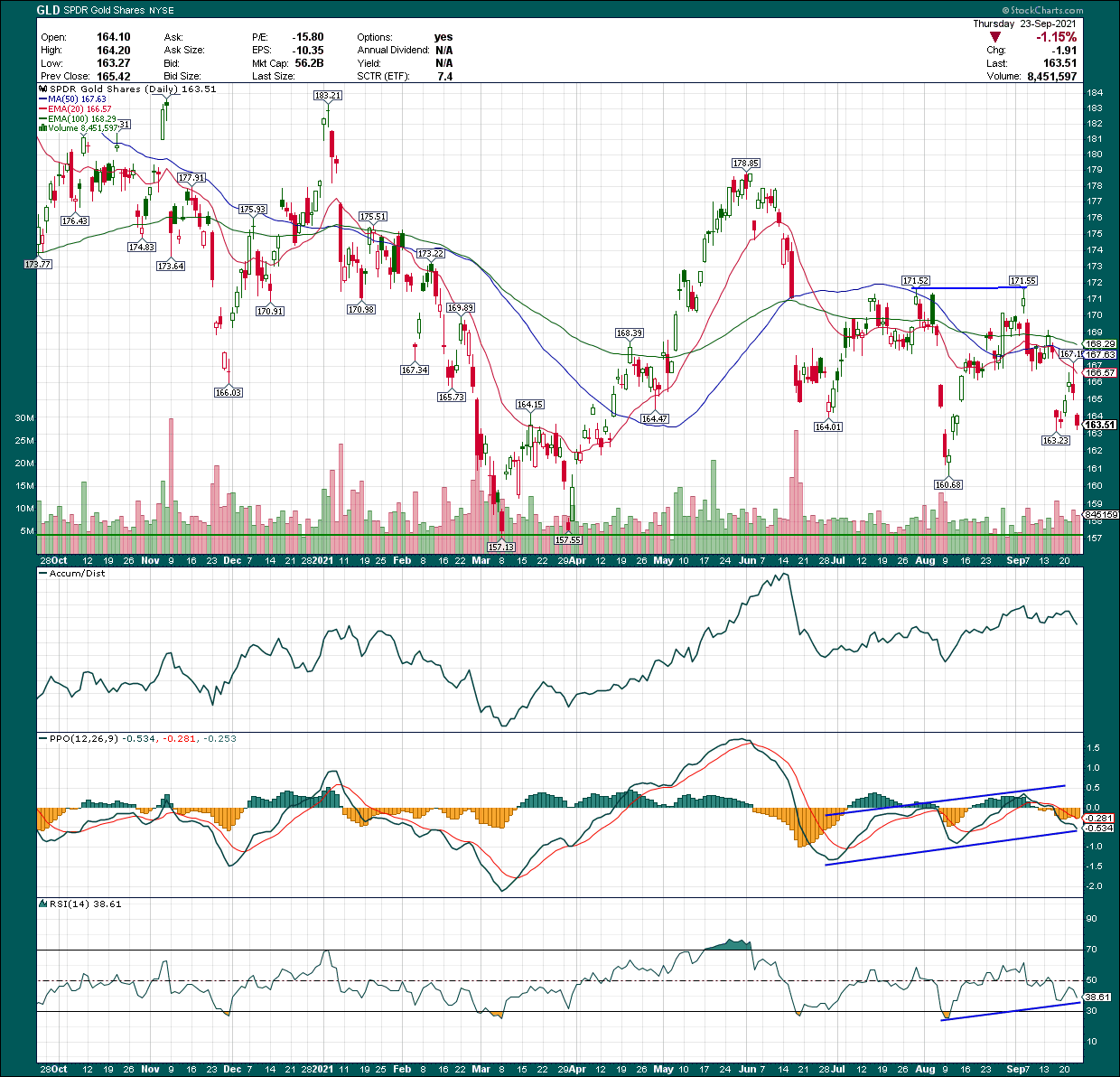

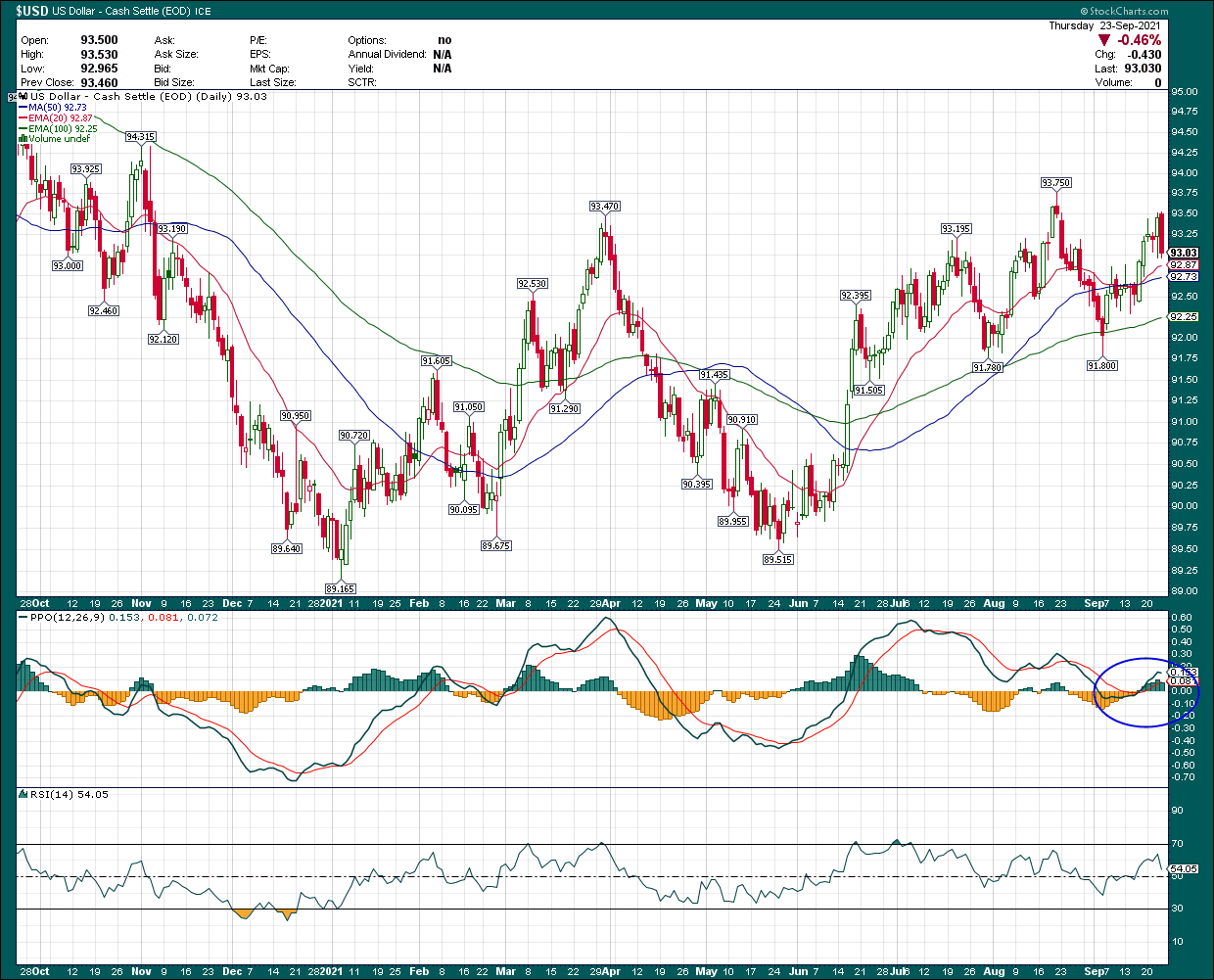

Gld Must Be Avoided Seeking Alpha

28 Finance Resume Templates Pdf Doc Free Premium Templates

Employee Report Template 28 Free Sample Example Format Download Free Premium Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Repayment

Debt Tracker Credit Card Debt Relief Debt Payoff Debt Free

Ex 99 1

Loan Servicing How Does Loan Servicing Work With Example

Free 28 Printable Accounting Forms In Pdf Ms Word

Employee Report Template 28 Free Sample Example Format Download Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Gld Must Be Avoided Seeking Alpha

Wisconsin Appraisal Continuing Education License Renewal Mckissock Learning

40 Business Credit Application Templates Free Business Legal Template